There have been a lot of changes in the housing market over the past couple of years, which may lead you to wonder if the time is right for you to make your next move. We broke down what you need to know about navigating today’s current market and how you can prepare yourself to make your next investment.

An Update on Interest Rates

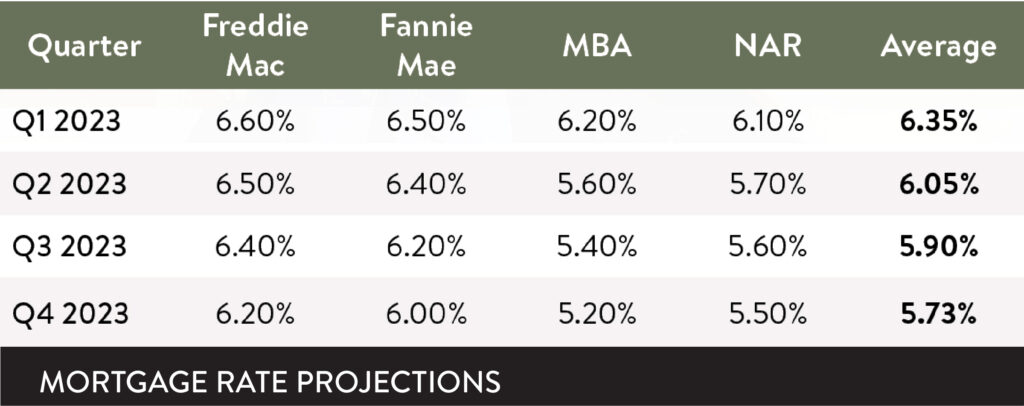

In 2022, mortgage rates experienced the largest and quickest increase in history. This came after a period of historically low interest rates during the pandemic. The rise in rates may have an impact on your purchasing power for a home, as the cost of borrowing money also increased. This means that the monthly payments on a mortgage loan may become more expensive, potentially reducing the amount of money you can borrow to purchase a home. However, there is some good news in that mortgage rates are predicted to decline by the end of this year, which may help to improve your purchasing power and potentially make homeownership more affordable.

While mortgage rates and home prices may fluctuate in the short term, buying a home is a long-term investment. If you plan to stay in your home for many years, you may be able to ride out any temporary fluctuations in the market and build equity over time.

If you are ready to make your move, start by working with a lender to get preapproved to see how much you qualify for. If you plan to wait until the end of the year, take this time to increase your savings to put toward your down payment.

Buying Power

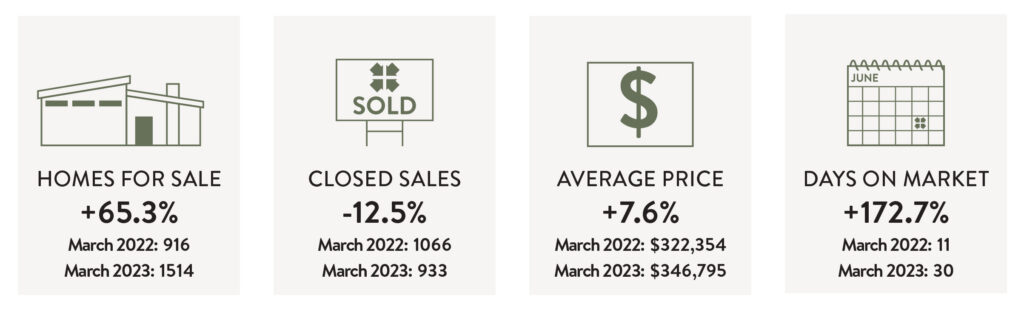

In some parts of the country, home prices have been rising rapidly in recent years. However, there are signs that the housing market is starting to stabilize, with more inventory becoming available and prices leveling off. This means that buyers may have more options and negotiating power when it comes to finding a home that fits their budget.

Compared to 2022, we are seeing significantly more inventory in Omaha available for buyers, and with the rise in mortgage rates, homes are staying on the market longer which means buyers have less competition, and it’s easier to get into homes.

The percentage of list prices received is down 2.6%, from 102.1 to 99.5. On average people aren’t paying as much over the listing price which is great for buyers. For sellers, they are still getting an average of 99%. In the Omaha Area Region, average sale prices of existing homes are up 9.3% year over year (Omaha Area Board of Realtors).

Sellers’ Market

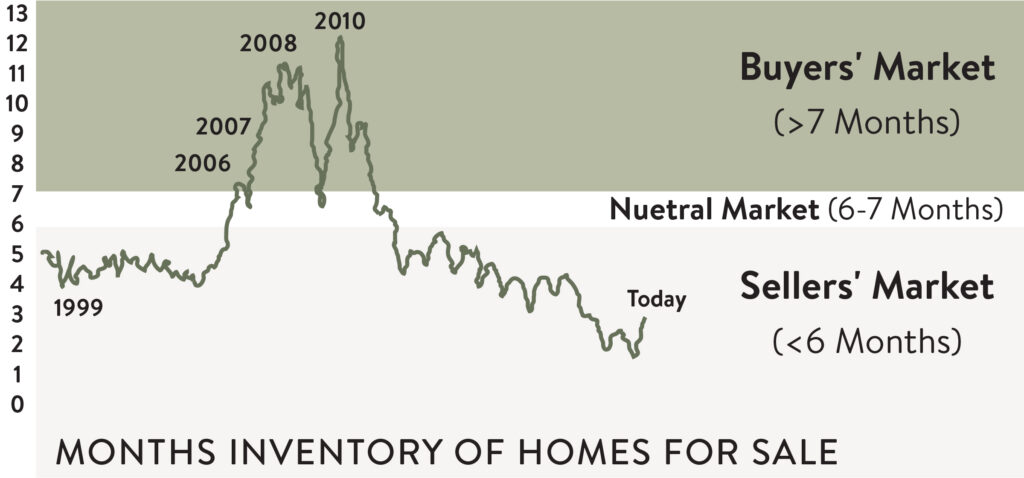

Omaha is currently in a sellers’ market with the average list price up 28.9%. In a sellers’ market, you can often anticipate bidding wars, higher prices, and quicker sales for homeowners. The market can change from day to day, and that will affect your listing strategy.

Working with a professional will help you get the best terms possible. If you are looking to sell your home, choosing a realtor who can provide you with the best comparative market analysis, and who understands the area is key to helping you get the most out of your sale. With professional research, pricing, and marketing, you can anticipate quicker sales and more money to bring into your next home.

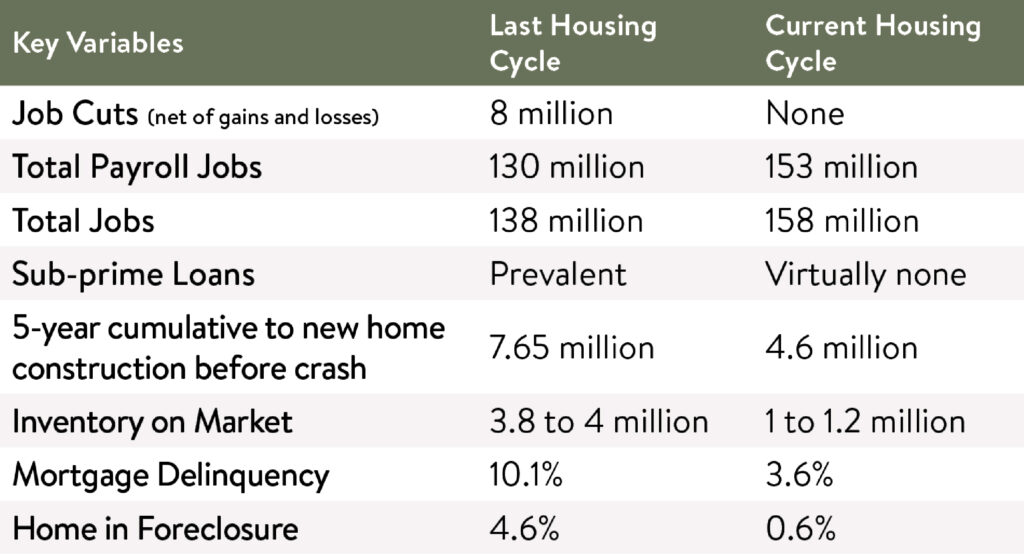

Is a Housing Crash Coming?

Comparing factors from the previous housing cycle the answer is no. The housing market has been experiencing a strong seller’s market for some time now, with high demand and low inventory driving up prices. Contrary to many recent news headlines, today’s economic factors are not indicative of a housing bubble or crash. While prices have risen rapidly in some areas, they are still generally in line with historical trends when adjusted for inflation.

Ready to make your move?

Our team of experienced agents is here to guide you every step of the way. Whether you’re a first-time homebuyer or a seasoned investor, we are with you for life!

***Data provided by Keeping Current Matters, Core Logic, Showingtime, and the Great Plains Regional MLS.

Leave a Reply