Are you ready to seize the opportunity in today’s ever-changing housing market? With home prices predicted to rise steadily and interest rates showing signs of stabilization, now might be the perfect time to make your move. In this month’s update, we’ll explore the latest trends, creative financing options, and inventory shifts to help you navigate your next real estate investment with confidence. Let’s dive in and see how you can get ahead in this dynamic market!

Home Price Predictions

Timing the market is a risky gamble. Let’s talk about how you can get ahead in this market. Experts predict a steady 3-4% annual rise over the next five years. While that’s a more moderate climb than we’ve seen recently, locking in today’s prices means you’re building equity with every passing year.

Interest Rates

Don’t Let Rate Expectations Hold You Back! Many are hoping for a significant drop in mortgage rates before making a move, but experts are now predicting a more gradual decline. While initial forecasts hinted at rates dipping below 6% by year’s end, current projections from Fannie Mae, MBA, and Wells Fargo suggest a more realistic stabilization closer to 6.5%.

This is the lowest rate for the 30-year fixed mortgage in two months, marking six consecutive weeks of rate declines. It results in a monthly savings of $60 on a $400,000 home, which represents a 20% decrease from when rates peaked recently at 7.04%. Is $60 a dealbreaker for someone purchasing a home? Perhaps not. However, it could influence a buyer’s financial perspective, shifting from the mid-6% range instead of 7%. Ultimately, vibes rather than data could prevail.

Creative Financing Options

The Good News: You Have Options!

Even with rates not dropping as quickly as hoped, homeownership is still within reach. There are many creative financing strategies available such as mortgage buydowns, ARMs, and assumable mortgages to make your dream home a reality, even in today’s market. Don’t let rate expectations dictate your future, contact me today so I can connect you with a local lender to explore what works for you.

1. Mortgage Buydowns

A mortgage buydown allows you to pay an upfront fee to lower your mortgage rate for a set period of time. This can be especially helpful if you want or need a lower monthly payment early on. In fact, 27% of agents say first-time homebuyers are increasingly requesting buydowns from sellers in order to buy a home right now.

2. Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages typically start with a lower mortgage rate than a traditional 30-year fixed mortgage. This makes them an attractive option, especially if you expect rates to drop in the coming years or plan to refinance later. And if you remember the housing crash, know that today’s ARMs aren’t like the risky ones back then.

“ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers’ ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

– Lance Lambert Co-Founder, ResiClub

In simple terms, banks used to give loans without checking to see if buyers could afford them. Now, lenders verify income, assets, and jobs, reducing the risks associated with ARMs compared to the past.

3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing loan — including its lower mortgage rate. And with more than 11 million homes qualifying for this option according to U.S. News, it’s worth exploring if you want or need a better rate.

Inventory

Do you know one of the biggest factors that determines whether homebuyers or sellers have more power during negotiations? It’s inventory. And lately, the supply of homes for sale has grown. That means things are shifting from the intense seller’s market of the past few years to a slightly more balanced market today. But this is going to vary a lot by area – it all depends on how many homes are for sale and how many buyers are looking in that local market.

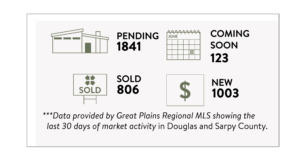

Local data from the first week of April!

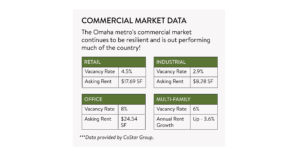

An Update on the Commercial Market

Ready to make your move?

Our team of experienced agents is here to guide you every step of the way. Whether you’re a first-time homebuyer or a seasoned investor, we are with you for life!

Leave a Reply