The latest data in the real estate market is here! We are happy to help you navigate the current market. Whether you are buying, selling, or just curious about the market, we have you covered!

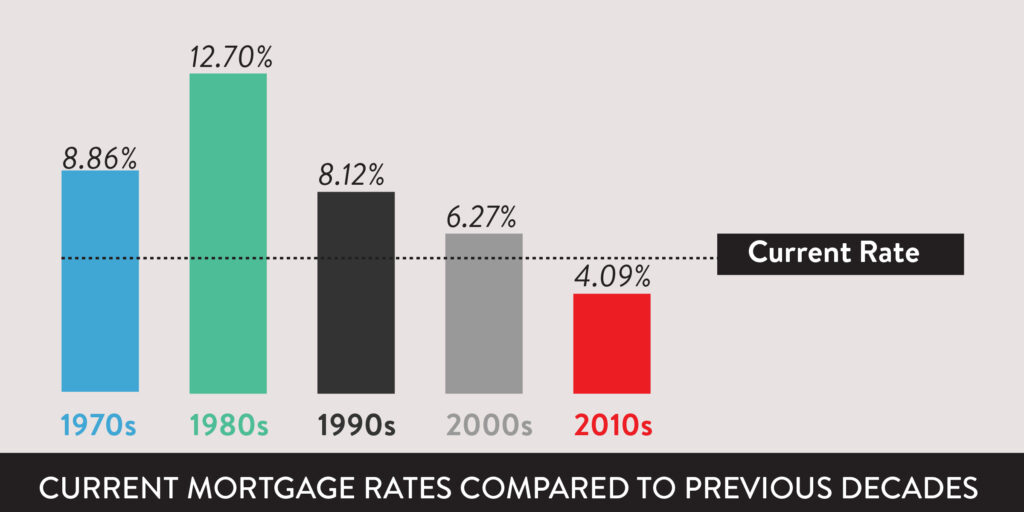

A Look into Current Mortgage Rates:

We have been seeing an increase in mortgage rates since January. However, mortgage rates are still significantly lower compared to the past five decades, this increase is leading to more inventory and longer listing times before homes sell.

Mortgage interest rates have jumped over two percentage points since January 2022, causing a significant impact on buyer’s purchasing power. NAR Chief Economist Lawrence Yun predicts interest rates to pull back under 5% in Q4 2022, bringing relief to buyers that were priced out of the market in recent months. Buying and selling a home in any market can be a difficult decision.

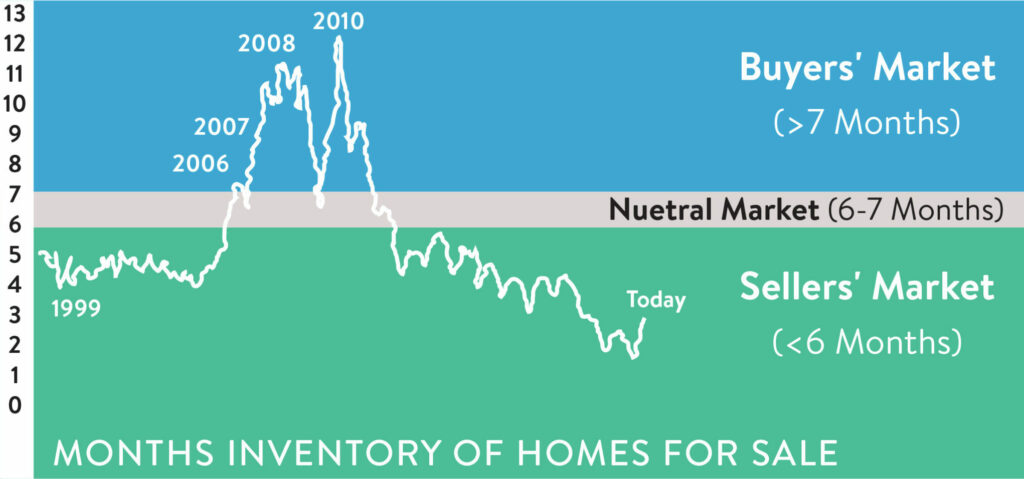

PJ Morgan Real Estate’s Residential Sales Director, Megan Bengtson says, “Headlines can be misleading. With the rise of interest rates and entering into a recession, we have seen a cool down in the market. The housing market typically leads the economy out of a recession. An even market has around a 6 month supply of inventory, and currently the Douglas/Sarpy county market has around a 1.3 months supply of inventory. Housing prices are stable and it’s still a great time to buy and sell.”

How Does the Market Impact Your Buying Power?

As interest rates increase even a small change can make a big impact on your monthly payment. For example, if your interest rate were to increase from 4.5% to 5.0%, the monthly payment for a 30-year $250,000 loan would increase by approximately $75.00/month. If you are considering purchasing a home right now, it’s important to lock in your rates now as a slight increase can impact your buying power and what you may be able to afford.

Although buyers’ purchasing power was negatively affected by increased interest rates, many qualified buyers are jumping back into the market as inventory increases. In July 2022, our local market saw a 30% increase in homes for sale as compared to this time last year. Buyers and sellers alike agree that the Omaha Metro real estate market is a desirable investment as sale prices continue to steadily rise.

Sellers

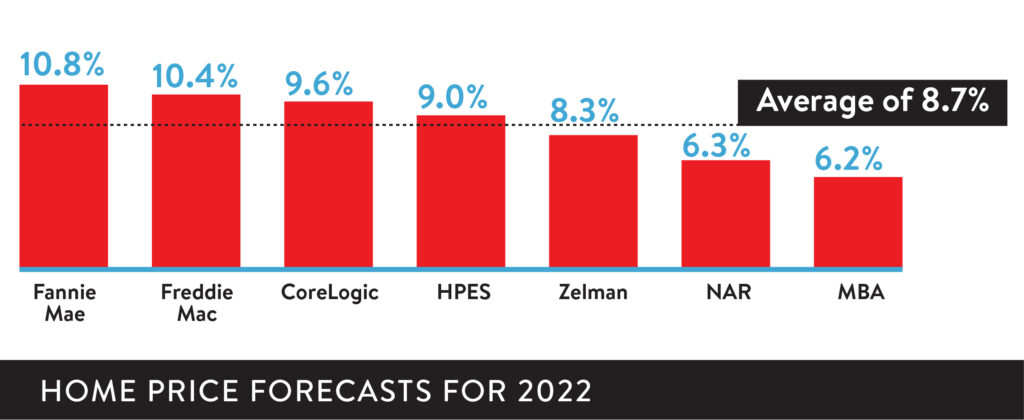

Buyer demand has slowed over the past few months. However, potential sellers should know that we are still in a strong sellers’ market. Last year the record low mortgage rates brought in more buyers to the market. Motivated buyers are still shopping, but it’s important to price your home right for today’s market. In the current market, we are seeing home prices increase an average of 8.7%. An economic slowdown does not mean prices will decline, instead, sale prices are predicted to increase at a slower pace than what we have seen in the recent past.

Kelsey Landenberger, REALTOR® says, “The frenzy of last April has certainly slowed but it is still a seller’s market. We keep saying the market has shifted from a speed-based market to a skill-based market. And with that shift, pre-list preparations, marketing, choosing the right REALTOR® , and excellent price strategy become extremely critical for sellers.”

“…supply remains fairly tight across most markets. The consequence is that house prices likely will continue to rise, but at a slower pace for the rest of the summer.”

-Sam Khater, Chief Economist, Freddie Mac

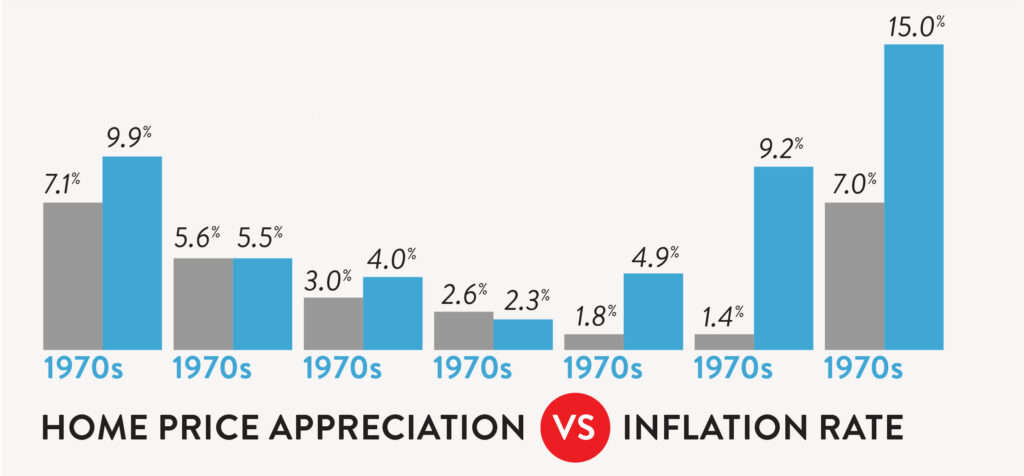

A Look into Home Appreciation

The last two years we have seen a moderate increase in home price appreciation. According to Keeping Current Matters, one reason why home prices appreciated quickly was due to record low mortgage rates. Nationally, home prices are predicted to continue to rise, but at a more moderate rate than in 2021. Buyer demand is decreasing, but homes that are priced right are selling fast. If you are considering selling, we can help you make sure your home is priced right!

“Renters actually have a harder time in inflationary periods, because rents tend to rise along with inflation, whereas mortgage payments stay the same for homeowners with fixed-rate mortgages.”

-Mark P Cussen, Financial Writer

Showings and Price Per Square Foot Data

Home showings have decreased since last year in Douglas and Sarpy County. Additionally, we are seeing an increase of 12% in the average price per square foot. This is due to the increased demand from buyers and historically low inventory in our local market. This increase in price per square foot means now is an ideal time to maximize your return on the sale of your home!

Kelsey Landenberger also adds, “Who is purchasing homes has also shifted some in the last month. There’s a decrease in cash buyers and vacation and investment purchasers. Also, we are seeing fewer offers per listing (though still multiple offers on average) and a slight decrease in buyers who are waiving inspections. While this is all good news for first time homebuyers, it is still a competitive market. So with all of this in mind, again it’s just crucial to make sure you’re in good hands with a great REALTOR® who can successfully guide you through the process.”

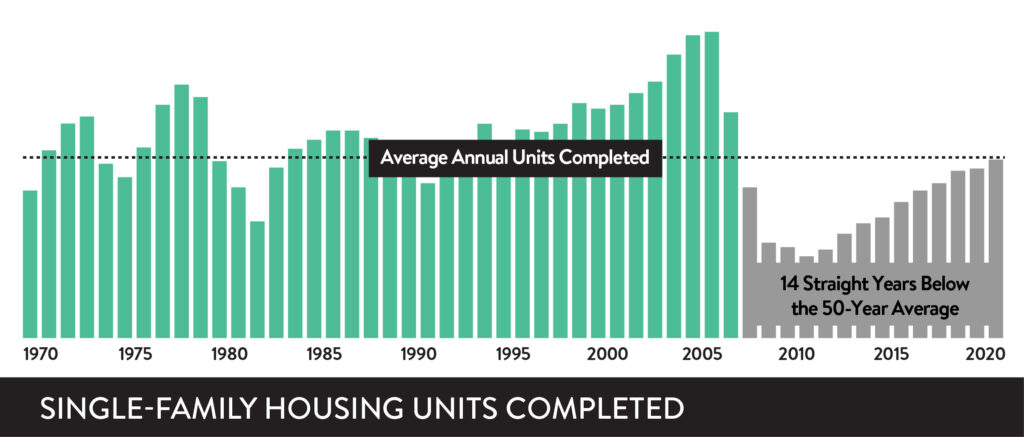

New Construction Home Builds Below Average

From 2005 until the present, new construction inventory on a national level has been below average. However, our local market has seen a 127% year-over-year increase in new construction inventory.

Still have questions?

Although we are seeing a shift in the housing market the market is still strong. If you are curious to learn more, we can help you navigate the current market!

Thanks for your information . i am read your article i am very impressive.

FindDigitalAgency